Finance Minister Nirmala Sitharaman has proposed key changes in the Union Budget 2023 regarding the Income Tax policy. Henceforth, ‘New Income Tax System’ will be the default option while filing returns. Those who are under the old tax system can continue to enjoy the same benefits as before. They can come under the new tax if they want. The changes made in the budget regarding the new tax regime are as follows…

In the new tax regime, previously Rs. They used to give rebate on income up to 5 lakhs. But, this time the income under the rebate has been increased to Rs.7 lakhs. No need to pay tax up to Rs.7 lakhs. No change has been made in the old tax system.

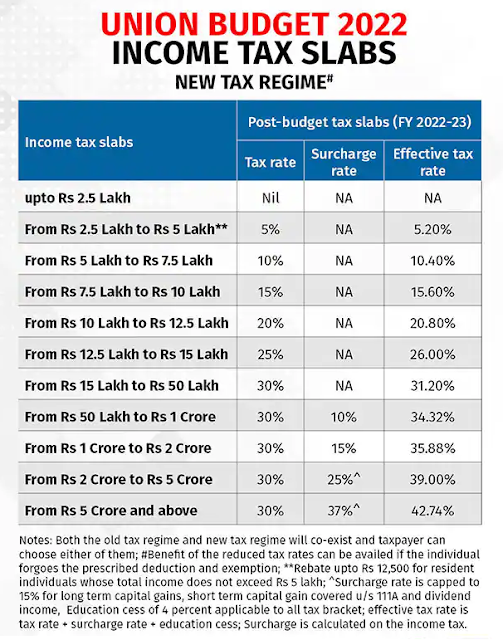

The number of slabs in the new income tax system has also been reduced. Earlier there were 6 columns.. they have recently been reduced to 5.

No tax is levied up to Rs.3 lakh.

5% tax is levied up to Rs.3-6 lakhs.

10% tax should be paid up to Rs.6-9 lakhs.

15% tax for Rs.9-12 lakhs and 20% for income between Rs.12-15 lakhs.

Under the new system, the highest tax rate of 30 percent will be levied on those whose income exceeds Rs.15 lakh.

For example, if a person named ‘A’ earns Rs.7 lakhs per year, the first Rs.3 lakhs will not be taxed. After 4 lakhs above, tax has to be paid according to the slabs. But, this time they gave a rebate on that amount. With this, there is no need to pay any tax up to Rs.7 lakhs.

If the annual income is Rs.15 lakhs, the tax may be up to Rs.1.5 lakhs. Earlier it was Rs. 1.87 lakhs. The surcharge rate on the highest income tax has been reduced from 37 percent to 25 percent.

* In the new tax system, if the income exceeds Rs.15.5 lakh, the standard deduction has been announced as Rs.52,500